Why Chinese Cars Are Winning Saudi Hearts: Explained

Saudi Arabia: The Saudi Arabian automotive market has witnessed a major evolution over the last five years or so. Just like many global markets, Chinese auto brands are eyeing a bigger slice of the market. In 2025, as compared to 2020, the presence of Chinese cars on Saudi roads was once a rare sight; you could find far fewer in between, only some curious buyers. This market has been dominated by Japanese, Korean and American brands with decades of presence and a loyal customer base. This is starting to change; if you take a drive through Riyadh traffic, the rapid shift is pretty apparent. Haval, Changan, MG, Jetour, and Geely vehicles now share the streets as commonly as Toyota and Nissan, as well as the Top Chinese Cars Worth Buying in Saudi Arabia in 2025.

KEY TAKEAWAYS

Which are the top Chinese brands present in Saudi Arabia in 2025?

Top Chinese brands in Saudi Arabia in 2025 include Haval, GAC, Chery, BYD, Geely, and Maxus.What is the price range and segment of the market that Chinese brands operate in Saudi Arabia?

The price range typically starts from SAR 50,000 and goes up to SAR 140,000, covering segments such as SUVs, sedans, hatchbacks, pickups, and EVs across the budget to mid segments.Make no mistake, this aggressive expansion is not random or accidental; it is a new reality, and rather a calculated strategy by Chinese automakers. They look to expand overseas after serving their local market and looking for aggressive growth. What is helping them attract buyers in the Kingdom is their competitive pricing, advanced technology, improved design, and tailored financing options, which boost confidence in these new brands. Furthermore, to accelerate this growth, Chinese brands are investing heavily in service networks and gaining consumer trust. All of this explains why Chinese cars are winning Saudi hearts, and this is just the beginning.

Top Chinese brands and their models in KSA

|

Brand |

Market Presence in Saudi Arabia |

Popular Models in Saudi Market |

Key Strengths |

|

Haval |

Popular with expanding network |

Economical SUVs, top features |

|

|

GAC (Moca) |

Fast-growing presence, gaining popularity |

GAC Trumpchi GS4, Moca |

Stylish and appealing design, affordable price |

|

Chery |

Known for quality service and the widest network |

Modest pricing, high on tech |

|

|

BYD |

Fast gaining customers approval, EV focus |

BYD Tang, BYD Seal |

One of the most recognized brands, highly regarded for tech and hybrid options |

|

Geely |

Another strong brand with a large customer base and expanding rapidly |

Contemporary SUVs, loaded with modern and enticing features |

|

|

Maxus |

Notable presence |

Commercial vehicles, pickups |

Story in Numbers

To comprehend the real market shift, just see the numbers, and they reveal the true story. Buyers are shifting towards Chinese brands, often overlooking established ones. The way buyers are shifting towards these brands over the more established ones. In 2024, Chinese brands strengthened their presence in the Saudi market, collectively capturing nearly 16% of new vehicle sales, a significant increase from previous years. Jetour leads the Chinese pack with an excellent 63% sales jump to 8,264 units in Saudi Arabia's first half. Haval also recorded 37% growth and sold 6,131 units, driven by demand for its popular models like the H6, Jolion, and H9, which are no longer niche vehicles but mainstream choices.

Established players Toyota, Hyundai, and Nissan are undoubtedly still holding the market with the highest market share, and they are not going anywhere anytime soon. But they have started to see market share slipping as Chinese brands such as Changan, Geely, and MG remain firmly in the top ten, challenging their traditional dominance. Here are the Best Chinese SUVs for Saudi Roads in 2025.

What is fueling the aggressive expansion of Chinese brands into the Middle East is the massive overcapacity in the home market, and all brands are looking to export as the next growth frontier. In 2024, it is reported that China exported over 5 million vehicles worldwide, and Saudi Arabia ranked among the top five export markets.

What makes them a Winner

The growing number of Chinese cars in annual sales is growing rapidly in Saudi Arabia, pointing towards the fact that these new brands are doing something right. What exactly makes them attractive enough for buyers to switch? Here are the top pointers.

Price is a key factor, but not the only one: First and foremost, for any car buyer that matters is price matters. And, yes, Chinese cars are far more affordable than European or Japanese equivalents. A Haval H6 costs roughly SAR 65,000-85,000, while a comparable Honda CR-V or Toyota RAV4 runs SAR 90,000-120,000. That gap is huge and makes a huge difference. But price alone doesn't explain the market shift; there are several other factors. Because customers do not always trust anything cheap, as reliability indeed matters.

A mix of the right product: One of the things that Chinese automakers are good at is understanding the customers well. They carefully know the customer preference, for example, Saudis want SUVs, and they look for desert comfort, family space, and that elevated driving position. Chinese brands promise exactly this and deliver remarkably well. The right examples are Haval H6 and Jolion, which tick all the boxes, such as modern design, spacious cabin with quality interior and decent power. What they also offer is advanced tech like navigation systems and climate control, and practicality. And none other than Jetour's success established this rather well. Their T1 and T2 SUVs sold 8,264 units in 2024 alone. Why? Because they're priced right for young families, they don’t pretend to be luxury, but are known for their practicality and affordability. And, they work just fine on Saudi roads. These are the Most Popular Chinese Car Brands Among Young Saudis.

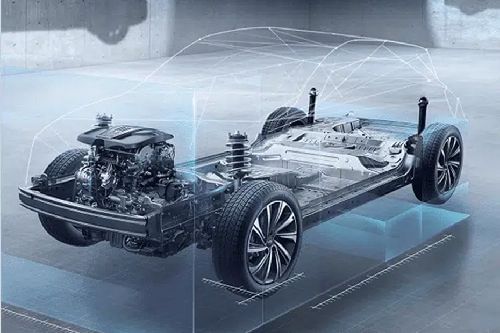

Technology integration is a game-changer. One of the areas the Chinese brand leads is new technologies, and offers great features that are one or two segments above in every car. For example, you get Chinese cars with 8-10 inch touchscreens, wireless charging, panoramic sunroofs, and advanced safety systems. All of these features were only available in luxury cars until just about five years ago. Now most of them are standard on mid-range Chinese models, while Japanese competitors charge a price premium to offer similar features, which makes it hard to compete as Chinese brands package them as standard.

Improved after-sales: Many Saudi car owners who bought Chinese cars early had experienced a rather unpleasant experience with the service network and the quality of service. This was a valid concern for everyone looking to give them a chance. However, Chinese brands learned their lessons quite well and improved dramatically on both fronts. Today, they are investing in dealerships, expanding them beyond major cities. Similarly, parts availability has improved, and warranty programs are now legitimate. Haval, for example, offers a 6-year or 200,000 km warranty. That's competitive with Toyota. Service costs are lower, too. Oil changes, repairs, and maintenance don't pinch anymore like premium brands.

Targeting the right buyers: To become the preferred car brand among local consumers and also get a sense of belonging, Chinese brands are making the right marketing investments. For example, they are sponsoring local events. Becoming part of the local culture, understanding the nuances. They advertise heavily and help with suitable financing support. Some offer zero-down payment options, which help well, especially for young buyers or families on a tight budget.

What’s working

Diversified Portfolio. It is noticeable that many Chinese brands have an extensive vehicle portfolio that consists of sedans, hatchbacks, compact SUVs, mid-size SUVs, and large SUVs. This is the exact opposite of their rivals, like Japanese brands that often limit buyers ' options by making them go through their entire lineup to find options. Whereas the Chinese brands allow the buyers to pick what he or she want at a price or a suitable model. This makes quite an impact on the buying experience and decision-making.

Constant updates. This is another characteristic of the Chinese brand that attracts buyers to their cars. The Haval H6 gets refreshed models regularly, with new engines, updated infotainment, better safety and styling too. That means the refresh cycle is faster, and buyers get the impression of getting something new, which is the latest in terms of tech or feature and not outdated. For example, Toyota updates every 5-7 years, and Chinese brands do it every 2-3 years.

Honest positioning. Chinese brands don't pretend to be luxurious. They're not trying to beat marquee brands; rather, their focus is on average buyers who want practicality, reliability and affordability. This direct and rather open approach serves well with Middle East buyers who value substance over brand prestige.

Oil market advantage. Saudi Arabia benefits from zero-tariff policies with certain trading partners. This reduces import costs for Chinese vehicles. The savings pass to consumers. The price advantage is built into the system, not just manufacturing efficiency.

The Future

Overall, from a global perspective, China is emerging as the most formidable market, and its brands are aggressively charting an export strategy. With that in mind, the Chinese brands likely to consolidate, Jetour and Haval, will maintain momentum because they've got product-market fit and actual customer satisfaction. Changan and Geely will adjust pricing and products or lose market share. Small players will find it hard to sustain and eventually disappear.

However, the bigger picture is the faster shift towards electric vehicles. BYD is a formidable name in this area, and the company has some key products in the KSA market. The Atto 3 is already leading from the front with a considerable market share in the local EV sales in the region. Then MG, Chery, Geely and other brands are bringing more EV models that are gaining popularity across segments, this will further tighten their grip in the market and make it hard for rival brands to compete. By 2027, Chinese EV brands will own a significant EV market share in the Kingdom.

Again, from global trends, it looks like Toyota’s dominance will see some decline but not disappear. Japanese brands will move upmarket to the luxury segments where Chinese brands struggle. The mid-market and budget segments are increasingly belonging to China. Whatever the case, it will be interesting to see how China-made cars change the market over the next five years.

The Reality

Chinese cars are winning Saudi hearts because they deliver what Saudis actually want at prices they can actually afford. That's not truly extraordinary, but just simple business practices that resonate with buyers. The Japanese manufacturers built a global name for themselves on exactly this principle decades ago. Chinese brands are doing the same thing now.

Assuming that Chinese cars are anything other than practical transportation choices is wrong. They're not better than premium brands, rather straightforward: solid vehicles at fair prices. For young professionals, families with tight budgets, and practical buyers, that's precisely what matters. The surprise isn't that Chinese brands are winning. The surprise is that it took everyone else so long to notice. And the growing numbers and their strong presence are a clear indication.

Jetour Car Models

Don't Miss

Latest Car News & Expert Reviews

- Latest

- Popular

You might also be interested in

- News

Featured Car

- Latest

- Upcoming

- Popular

Compare & Recommended

|

|

|

|

|

|

Transmission Type

Automatic

|

Automatic

|

Automatic

|

Automatic

|

Automatic

|

|

Engine Displacement

1998

|

1998

|

1998

|

1995

|

1998

|

|

Power

251Hp@5500rpm

|

170Hp@6600Rpm

|

187Hp@5500rpm

|

154Hp@6000rpm

|

251Hp

|

|

Torque

-

|

203Nm@4400-4800rpm

|

350Nm@1800-4800rpm

|

196Hp@4000rpm

|

-

|

|

|

Trending SUV

- Latest

- Upcoming

- Popular